unemployment tax refund update 2021

Thousands of taxpayers may still be waiting for a. Typically you do not need to file an amended tax return to get the unemployment benefit refund with the IRS automatically crediting the money to your account.

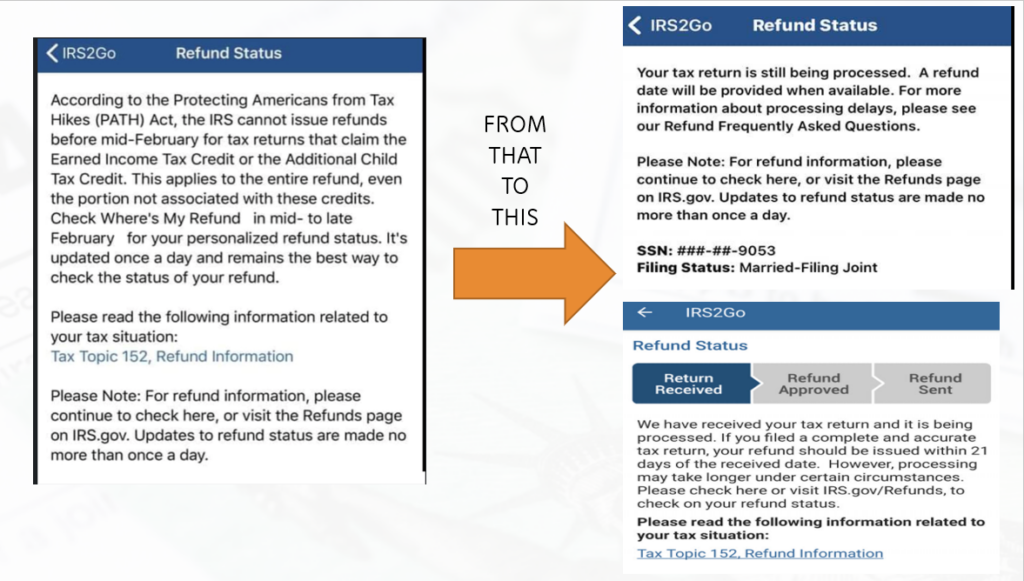

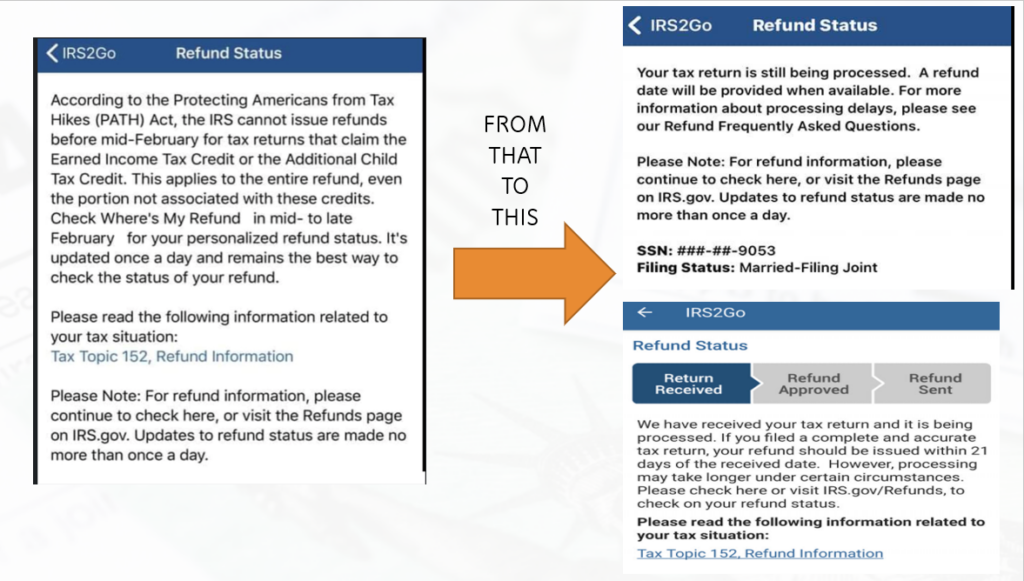

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest

For some there will be no change.

. They also serve as a resource for unemployed workers seeking UI benefits. The IRS began making adjustments to taxpayers tax returns in May in the first of several phases to correct already filed tax returns to comply with the changes under the American Rescue Plan Act of 2021 ARPA which allows an exclusion of unemployment compensation of up to 10200 for individuals for taxable year 2020. DOR sent a communication to all taxpayers who filed a 2020 income tax return on or before April 9 2021 reporting unemployment income.

Irs unemployment tax refund august update. Please follow the steps below as well to track your refund. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

May 15th 2021 1848 EDT. People who received unemployment benefits last year and filed tax. The IRS plans to send another tranche by the end of the year.

Check For The Latest Updates And Resources Throughout The Tax Season. The American Rescue Plan Act of 2021 ARPA excluded up to 10200 in unemployment compensation per taxpayer paid in 2020. Premium federal filing is 100 free with no upgrades for unemployment taxes.

However some may take longer ie. IR-2021-151 July 13 2021. There are several reasons this.

He said under the American Rescue Plan of 2021 enacted in March up to 10200 of unemployment benefits would be tax-free. Employers fund the UI program. Filers who paid their taxes early did not deduct those funds and.

This Notice addresses the unemployment compensation exclusion also unemployment exclusion in the federal American Rescue Plan Act and its effect on the taxable income of Michigan resident taxpayers under the Michigan Income Tax Act. It can take up to two years to receive your refund. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

UI Online for third party administrators TPA Employers play an important role in providing unemployment insurance UI benefits to workers. The 10200 is the maximum amount. This Notice is an update to the Notice published April 1 2021 and provides guidance to taxpayers.

An estimated 13 million taxpayers are due unemployment compensation tax refunds. Learn How Long It Could Take Your 2021 State Tax Refund. Do not file an amended 2020 return before you hear from us.

Congress hasnt passed a law offering. The irs is recalculating refunds for people whose agi is 150k or below and who filed before the tax law that changed the amount of unemployment that. 100 free federal filing for everyone.

This is the fourth round of refunds related to the unemployment compensation exclusion provision. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. If you PAPER FILED- note the IRS has over 20M returns to process and are severely understaffed.

The American Rescue Plan signed earlier this year excluded up to 10200 in unemployment compensation per taxpayer paid in 2020. Millions of Americans who received unemployment benefits in 2020 are awaiting their tax refund as the IRS adjusts their tax returns to include tax break. UI benefits offer workers temporary income while theyre out of work or working reduced hours.

Those who filed taxes before the bill was enacted would qualify for a. If Ive already filed my 2020 income tax return should I file an amended return to claim the new deduction. Ad See How Long It Could Take Your 2021 State Tax Refund.

The most recent batch of unemployment refunds went out in late july 2021. WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes on unemployment compensation received last year. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. The agency had sent more than 117 million refunds worth 144 billion as of Nov. Most tax refunds are issued within 21 days if e-filed.

The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. Ad File your unemployment tax return free. May 27th 2021 1027 EDT.

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Tax Refund Timeline Here S When To Expect Yours

Where S My Refund Home Facebook

Tax Refund Stimulus Help Facebook

Irs Tax Season 2021 Starts Friday From Stimulus Checks To Unemployment Benefits Here S What You Need To Know Federal Income Tax Income Tax Property Tax

You Have One Last Chance To Get A Surprise Tax Refund This Year The Irs Says

Where S My Refund Home Facebook

Wow This Is Crazy Fourth Stimulus Check Update Today 2021 Daily News Daily News Tax Refund Government Shutdown

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Where S My Tax Refund How To Check Your Refund Status In 2021 Tax Refund Filing Taxes Tax Services

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Where S My New York Ny State Tax Refund Ny Tax Bracket

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Tax Refund Timeline Here S When To Expect Yours

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time